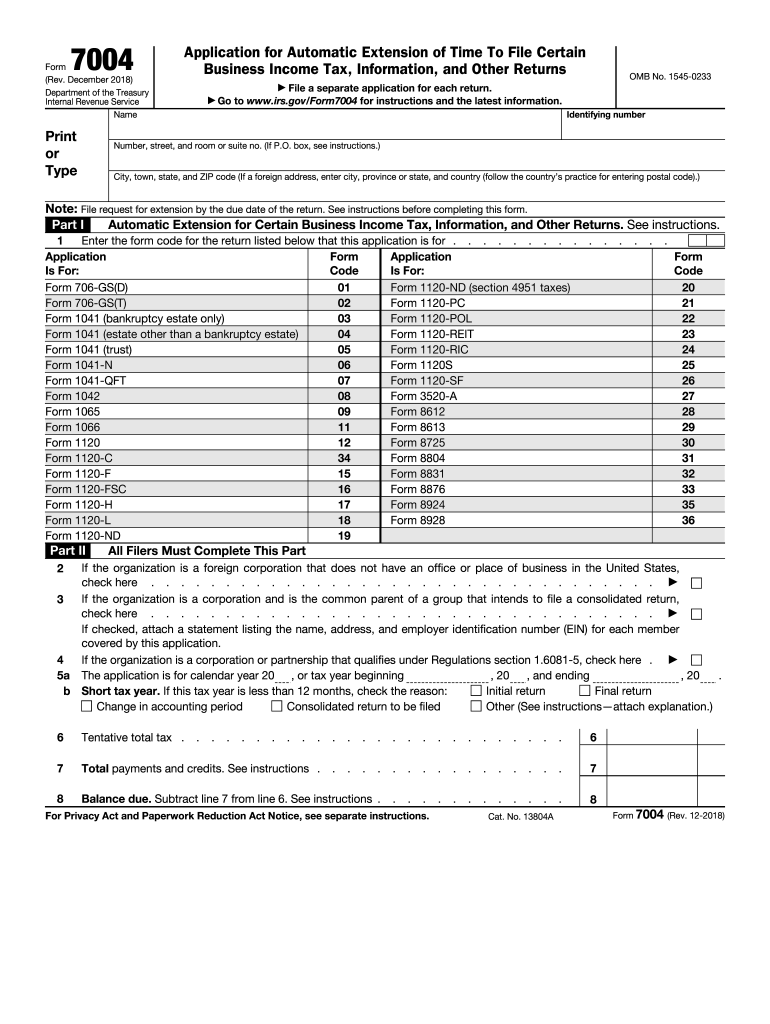

Who needs a form 7004?

Sometimes you need a bit more time to get your business’s house in order. Thankfully the IRS allows businesses to apply for an extension on their 2016 tax return. To do this, the business needs to fill out and submit IRS Form 7004.

What is form 7004 for?

If your business files as a partnership, corporation or S corporation, you can use the Form 7004 for an automatic extension. Pay close attention to the lines 2 through 6 on this form, as most apply to specific types of corporations only. Also, note that the 7004 does not mean that you can put off paying your tax liability (or at least the estimated amount of that liability). The extension only applies to the tax return your business will file later in the year, so be sure to pay the estimated tax by your business’s tax deadline.

Is it accompanied by other forms?

It doesn’t require any addenda.

When is form 7004 due?

For businesses whose tax years end on December 31st, the deadline would be March 15th, 2016. The rule is to file form 7004 before the due date of the return that you need extension for.

How do I fill out a form 7004?

After you write your contacts and identifying number, determine what kind of extension you apply for and fill out either part I (automatic 5-month extension for filing forms 1065, 8804, 1041) or part II (automatic 6-month extension for filing a number of other forms). You can choose the necessary return from the list given in the form 7004. Then complete part III to determine the dates of extension.

Where do I send it?

Mail it to the IRS or submit it electronically at the IRS official website.