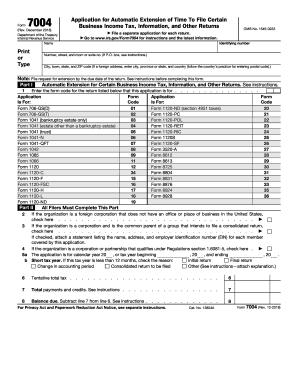

IRS 7004 2025-2026 free printable template

Instructions and Help about IRS 7004

How to edit IRS 7004

How to fill out IRS 7004

Latest updates to IRS 7004

All You Need to Know About IRS 7004

What is IRS 7004?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

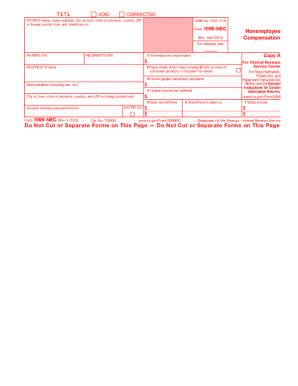

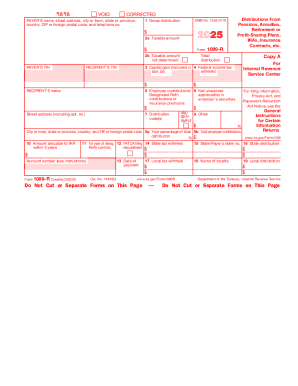

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 7004

What should I do if I made a mistake on my IRS 7004 form after submission?

If you've made a mistake on your IRS 7004 form after submission, you can amend it by filing a corrected form. Clearly mark it as 'Amended' and ensure that all corrections are accurate. It's important to keep a record of your submission and any correspondence related to the amendment.

How can I verify that my IRS 7004 form has been processed?

To verify the status of your IRS 7004 submission, you can contact the IRS directly or check their online resources for tracking options. Keep in mind that processing times may vary based on volume, especially during peak filing seasons.

What should I do if my IRS 7004 submission is rejected?

If your IRS 7004 submission is rejected, the IRS usually provides an error code and explanation. Review the error message, correct any listed issues, and resubmit your form promptly to avoid penalties or delays.

Are there any special considerations for nonresidents filing IRS 7004?

Nonresidents filing IRS 7004 should understand the specific requirements related to their status. It's crucial to provide the correct identification number and any additional documentation that may be necessary for compliance.

See what our users say